Mirato Introduces New Mitigation Planning Module

| By The Mirato Team

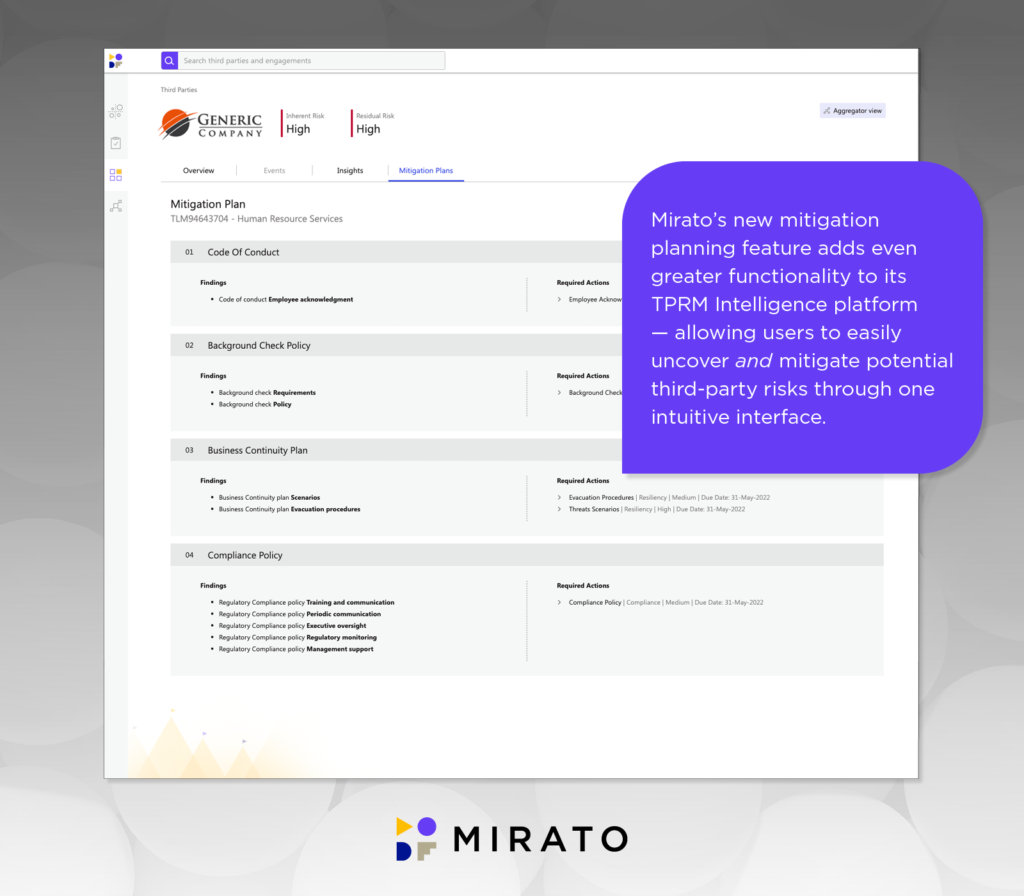

New Module Enables Mirato to Provide Complete, End-to-End Automated Platform for Greater Visibility into Potential Third-Party Risks and Action Plans to Effectively Mitigate Them

As appeared at Financial IT and AIThority

Tel Aviv, Israel — June, 2022 — Mirato, provider of an AI-enabled third-party risk management (TPRM) intelligence platform, today announced its new mitigation planning module, designed to quickly build plans to fix and mitigate risk issues that emerge out of the TPRM due-diligence process, including failed controls, cyber-attacks, products with licensing issues, issues resulting from unplanned external events such as adverse weather or geopolitical crisis, human errors, and more. With the added mitigation planning module, users of Mirato’s TPRM Intelligence Platform can plan towards the effective mitigation of potential risks in one complete, easy-to-use solution, rather than working simultaneously in a multitude of platforms such as the enterprise management systems and TPRM workflows, along with the plethora of data sources involved in the process.

Mirato’s AI-powered insights generate automated mitigation plans to address issues and deficiencies found during due diligence, periodic reviews, ongoing monitoring, and desktop or on-site control assessments. This reduces the manual effort and tedious nature of current approaches while improving the quality and consistency of this work product. Mirato mitigation plans are driven by the client’s unique TPRM program, risk appetite and framework requirements, and include details of all deficiencies, roles, responsibilities, steps, timing, requirements etc., required to remediate the identified shortcomings.

The organization can easily view Mirato mitigation plans on screen, instantly convert them into your company branded and formatted power point for easier and more effective communication between the relationship manager and the third party, and/or output them to your issue management system to trigger external workflow and progress if desired. By significantly reducing the time and manual effort Analysts and SME must sift through evidence and documentation, they can focus on more strategic, higher-value activities, maximizing their time and expertise. For some firms, this translates to managing more TPRM program volume, more risk types, reporting on risk more frequently, more third-party types, ability to focus on innovation, performance, program improvement and evolution, etc.

The Mirato TPRM Intelligence Platform results in substantially less manual labor and can cut assessment costs by up to 60%, while allowing heightened risk visibility. It is revolutionizing third-party risk management for the financial services industry by leveraging artificial intelligence (AI), natural language processing (NLP), and sophisticated data harvesting to elevate existing TPRM programs and tools and streamline an entire operation’s data into one smart platform. The Mirato TPRM Intelligence Platform continuously collects information from all of an organization’s data sources while analyzing and creating a feedback loop between them. This creates concentration risk visibility (for 4th parties, location, vulnerabilities and more) at the press of a button and enables actionable insights—ultimately allowing subject matter experts (SMEs) to focus on risk mitigation rather than data administration.

The new mitigation planning tool features an intuitive UI and can be used in multiple ways depending on an organization’s specific needs, including data review, which can happen in parallel with multiple SMEs reviewing their specific risk domain, e.g., physical security and cybersecurity. A mitigation plan task will be unlocked following the data review process or can be utilized as a stand-alone option.

“The problem with data is not the lack of it, but the number of resources it takes to collect it, the challenge of getting clear insights fast, and the ability to easily act on those insights,” said Etai Hochman, Mirato co-founder and CTO. “Adding mitigation planning to the Mirato platform answers all three challenges and takes our platform to the next level by providing previously unavailable insights and an intuitive, efficient, and effective method to address them.”

Mirato’s proprietary AI and NLP algorithms analyze the content of the data source and use cross-validation to get the correct information to the right people at the right time so they can make an informed decision. As a result, Mirato enhances every TPRM environment—even firms with sophisticated and mature programs can drastically reduce the time, effort, and cost of the TPRM program while improving the efficiency, accuracy, process integrity, and effectiveness of compliance.

Press the image to see a larger version

About Mirato

While traditional TPRM solutions automate workflow, Mirato automates the actual manual work. Mirato’s TPRM intelligence platform elevates existing third-party risk management programs and tools by streamlining an entire operation’s data into one smart platform. The Mirato platform replaces what was previously multi-destination, manual-intensive labor, and is easily managed from one dashboard. This saves time and money (up to 60% of assessment costs) while increasing an organization’s ability to mitigate risk in an ever-evolving risk landscape.

Mirato was featured as a vendor driving innovation in Risk and Compliance Management in the Gartner® Competitive Landscape: Integrated Risk Management report. For more information, visit https://www.mirato.com

# # #

For more information, contact:

Jill Colna

SVM Public Relations

401.490.9700